Worst Start for Retail Sales since 2009

Retail sales rose by 1.8% year on year during the first two months of 2025. That was the worst start of a new year performance since the -11.2% annual plunge of January-February 2009, where the latter two months were from the depths of the Great Recession.

Excluding gasoline station sales, retail sales rose by 2.0% yearly during January-February 2025 for the smallest such increase since the 1.8% of January-February 2017. However, unlike January-February 2017, consumer sentiment now sinks as jobs growth fades.

January-February 2025’s 61.3-point average for consumer sentiment was well under the 97.4-point average of January-February 2017. And the 138K new jobs per month of January-February 2025 was less than the 220K new jobs per month of January-February 2017.

Consumer discretionary shares plunge by -16% for 2025-to-date …

Stocks that cater to discretionary consumer spending have fared poorly since the end of 2024. Compared to the S&P 500’s recent 2025-to-date drop of -4.6%, an index of consumer discretionary share prices plunged by -16.0%, while index of share prices for companies that focus on consumer staples was up by 2.4%.

E-commerce sales may have matured …

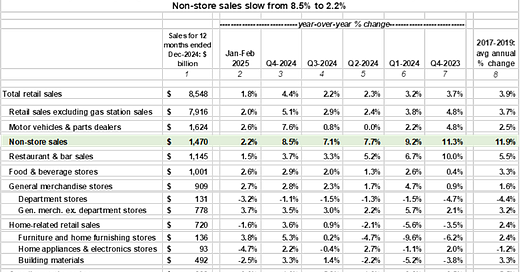

One of the more surprising aspects of early 2025’s slump by retail sales was the plunge by the yearly growth rate of non-store sales from Q4-2024’s 8.5% to the 2.2% of January-February 2025. The latter raises the possibility that the much faster growth of e-commerce sales relative to other retail sales may be drawing to a close. In other words, e-commerce sales may have reached maturity.

Home-related retail sales struggle …

Housing-related retail sales will be flat to lower until a deep plunge by the 10-year Treasury yield to 3.5% or lower enlivens the now moribund pace of existing home sales.

The National Association of Home Builders (NAHB) housing market index sank by -10.5% year-on-year for 2025’s first quarter. Also, the first two months of 2025 revealed year-on-year setbacks of -6.9% for homebuilding permits and -2.9% for housing starts. Little wonder that an estimate of home-related retail sales fell by -1.6% annually during January-February 2025 following year-on-year gains of 3.6% in Q4-2024 and 0.9% in Q3-2024.

Sky-high utility bills weigh on consumer spending …

Elsewhere, the first two months of 2025 showed a 1.7% year-on-year increase by industrial production that included gains of 0.9% for manufacturing output, 0.8% for natural resource extraction, and 8.1% for the distribution of electricity and natural gas. The latter brings attention to how a cold winter swelled the utility bills of US households.

In response to costlier home energy, many consumers may have reduced spending on other items. Nevertheless, many refuse to pay their utility bills in order to maintain spending even on discretionary goods and services. Still, I would not be surprised if the yearly growth rate for restaurant sales incurs something worse than the slowdown from Q4 2024’s 3.7% increase to January-February’s 1.5% rise.

Retail sales warn of slowest quarterly rise by real consumer spending since COVID recession …

In response to weak showing by retail sales during the first two months of 2025, the Atlanta Fed’s GDPNow near-term forecasting model lowered Q1 2025’s expected annualized quarterly growth rate for real consumer spending from 1.1% to 0.4%. The latter is well under Q4-2024’s 4.2% and would be real consumer spending’s worst sequential showing since the COVID-recession inspired -30.6% annualized quarterly contraction of 2020’s second quarter.

When compared to the current and previous economic recoveries, a 0.4% annualized quarterly uptick by Q1 2025’s real consumer spending would be the slowest since the 0.4% of 2011’s second quarter. In response to disinflationary consumer spending, Q2-2011’s 3.21% calendar-quarter average for the 10-year Treasury yield would sink to 1.82% by 2012’s second quarter.

All else being the same, real consumer spending will rise by a scant 0.5% annualized from Q4 2024 to Q1 2025, if real consumer spending edges higher by 0.1% monthly, on average, during February and March.

Subdued growth by payrolls would be consistent with a slower than 3% annual increase by yearlong 2025’s retail sales. In fact, slower growth by household expenditures would reinforce a deceleration by hiring activity. Only an unexpectedly deep drop by benchmark Treasury yields might be capable of upending forecasts of slower growth for both domestic spending and payrolls.

Danger ahead if retail sales does not grow faster than 2% annually in 2025 …

Retail sales moving 12-month sum slowed from the 3% increase of the span ended February 2024 to the 2.7% rise of the span ended February 2025. In the event this metric approaches 2.0%, a recession may be at hand.

During the three years prior to COVID, retail sales grew by 3.9% annualized, on average, during 2017-2019. The span included a 2018 high of 4.4% for retail sales growth and a 2019 low of 3.2%.

Thanks to the biggest application of fiscal and monetary stimulus since World War II, calendar year 2020’s retail sales managed to eke out a 0.7% annual gain despite a recession and COVID-related shutdowns.

The continuation of COVID-inspired stimulus and its after-effects, as well as the worst bout of rapid price inflation since the early 1980s (the latter being a consequence of massive stimulus), delivered unsustainably outsized annual advances by retail sales of 18.4% in 2021 and 8.9% in 2022.

Thereafter, retail sales’ annual increases slowed to 3.4% in 2023 and 3.1% in 2024.

Through 2024's first two months, retail sales grew by merely 1.8% year-over-year according to preliminary results. Given the ongoing tightening of fiscal policy that consists of higher tariffs (read higher taxes) and reduced federal spending (if only by way of DOGE), yearlong 2025's annual rise by retail sales might be the slowest since 2020's 0.7%.

Retail sales growth of less than 2.5% annually in 2025 would favor at least three Fed rate cuts meaning the federal funds rate would end 2025 no higher than 3.63% compared to the now 4.38%.