Military and Trade Wars Menace Outlooks for Economy and Markets

The US economy now slows. Both trade wars and military wars will curb business and consumer spending going forward. Illustrating the ongoing deterioration of US business activity was the plunge by the average monthly percent change for retail sales from the 0.5% advance of 2024's final five months to the -0.1% dip of 2025's first five months.

If the Israel-Iran conflict does not widen, financial markets and the world economy will not suffer appreciably. Thus far, the price of WTI crude oil has yet to approach $80 per barrel, never mind the $100 per barrel that would push the odds of a recession above 75%.

The prices of earnings-sensitive assets would likely sink if the US places uninvited “boots on the ground” in Iran. Markets would prefer Iranians take the lead at regime change.

On the other hand, markets may rally if bunker-bombs obliterate Iran’s nuclear weapon capabilities.

Price cuts on housing may be a sign of things to come …

May’s much lower-than-anticipated retail sales suggest consumers have begun to retrench in response to persistently elevated prices. Flat-to-lower home sales now prompt home builders and sellers of existing homes to cut prices. Unwanted inventories and underutilized consumer services might soon trigger the price discounting of consumer goods and services.

The Wednesday, June 18 report on weekly claims for unemployment insurance may offer useful insight as to whether the US job market has softened by enough to favor a further slowing of household expenditures.

FOMC is likely to expect slower growth, more joblessness, and faster inflation …

The federal funds rate will stay at its current 4.38% following the June 18 conclusion of the latest FOMC meeting. Markets will focus on the quarterly update of the FOMC’s dot-chart projections.

After having already dropped from December 2024’s 2.1% to March 2025’s 1.7%, the FOMC’s projection for Q4 2025’s year-on-year growth rate for real GDP might drop under 1.5%. Early June’s Blue Chip consensus predicted a 0.7% yearly uptick by fourth-quarter 2025’s real GDP.

In conjunction with a downwardly revised projection for Q4 2025’s real GDP growth, the FOMC lifted its predicted unemployment rate for 2025’s final quarter from December 2024’s 4.3% to March 2025’s 4.4%. As inferred from the Blue Chip consensus forecast of a 4.6% jobless rate for Q4 2025, the FOMC will probably again ratchet up its predicted jobless rate for Q4 2025 to 4.5%.

Despite the FOMC’s expectations of slower real GDP growth and a higher jobless rate, the FOMC lifted its expected annual rates of inflation for 2025’s final quarter from December 2024’s 2.5% to March 2025’s 2.7% for the PCE price index and from 2.5% to 2.8% for the core PCE price index.

In view of how early June’s Blue Chip consensus expects faster annual inflation rates for Q4 2025 of 3.2% for the PCE price index and 3.4% for the core PCE price index, the FOMC will probably raise its predicted inflation rates for 2025’s final quarter.

Because the FOMC’s expectations of slower economic growth and higher unemployment will be offset by expectations of faster price inflation, the FOMC’s likely June 2025 projection of a 3.9% federal funds rate for year-end 2025 will match the FOMC’s projections from December 2024 and March 2025. Fed funds futures recently assigned an implied probability of 63% to fed funds ending 2025 at a rate no higher than 3.88% as inferred from the CME Group’s FedWatch Tool.

Lower-than-expected retail sales to lower corporate earnings forecasts …

The consensus expected May’s retail sales would be unchanged from April and that, after excluding an anticipated drop by autodealership sales, remaining retail sales would increase by 0.3% monthly. In stark contrast to the consensus predictions, May’s retail sales plummeted by -0.9% monthly and still fell by -0.3% monthly after excluding autodealership sales’ -3.5% monthly dive.

Moreover, the results for the two prior months were revised lower. The Census Bureau’s original estimate of a 0.1% monthly rise by April’s retail sales was restated to a monthly decline of -0.1%. In addition, the previous estimate of a 1.7% monthly advance for March retail sales was lowered to a monthly increase of 1.5%.

Retail sales decent year-on-year growth rate may soon turn lower …

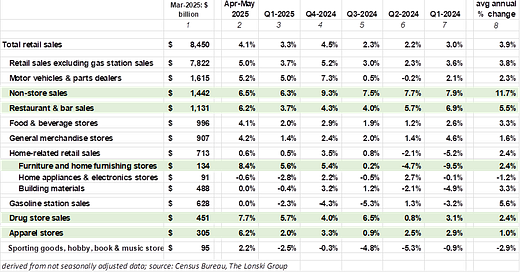

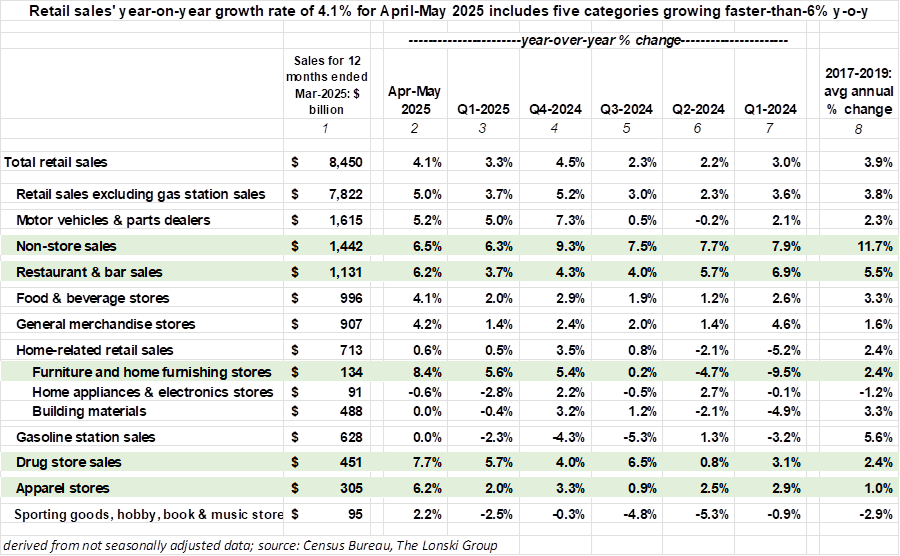

Though the month-to-month changes for seasonally-adjusted retail sales have been weak, retail sales’ year-on-year percent changes for the April-May span have been decent. After slowing from Q4-2024’s 5.2% to Q1-2025’s 3.7%, the yearly increase for retail sales excluding gas station sales recovered to 5.0% for April-May.

Five categories of retail sales managed to grow faster than 6% annually during April-May. April-May’s yearly growth rate for sales was led by the 8.4% of furniture and home furnishing stores notwithstanding a subpar performance by home sales. However, the very low base of 2024’s second quarter lent an upward bias to the Q2-2025-to-date yearly growth rate of furniture and home furnishing store sales. Overall, April-May 2025 showed a slight 0.6% annual rise by home-related retail sales as sales at home appliance and electronics stores dipped by -0.6% annually and building-material store sales were unchanged from a year ago.

Other categories posting a yearly sales increase of faster than 6% for April-May were the 7.7% of drug stores, the 6.5% of non-stores (namely e-commerce), and the 6.2% shared by restaurants & bars and apparel stores.

Because of a maturing market, the annual growth rate of non-store sales should continue to approach the annual growth rate of all retail sales. Long gone for non-store sales is anything resembling the category’s 11.7% average annualized growth rate of 2017-2019.

May retail sales prompt downward revisions of Q2-2025’s consumer spending and GDP forecasts …

May's much lower than expected retail sales triggered a downward revision of GDPNow's estimate for Q2 2025's annualized quarterly growth rate by real consumer spending from 2.5% to 1.9%. Nevertheless, the latter still tops Q1 2025’s 1.2% annualized quarter-to-quarter rise.

The monthly percent change of real personal consumer expenditures shows a very high correlation of 0.92 with the monthly percent change of real retail sales, where the latter metric is from the St. Louis's Fed FRED data base.

As inferred from the statistical relationship between the monthly percent changes of real consumer spending and real retail sales, May's -1.0% monthly drop by real retail sales favors a -0.4% monthly decline by real consumer spending. All else being the same, if May's real consumer spending does drop by -0.4% from April and if June's real consumer spending partly rebounds from May's drop with a 0.3% monthly gain, Q2 2025's real consumer spending will rise by 1.8% annualized from Q1 2025's pace.

For 2025’s second half, early June’s Blue Chip consensus looks for slower-than-1% quarter-to-quarter average annualized growth rates for both real consumer spending and real GDP. Thus, any forecasts of faster-than-3% annualized growth rates for 2025’s second half are worthy of skepticism.

Housing market index favors worst peak spring sales season for housing since 2012 …

The three months of April, May, and June, or the calendar year’s second quarter, correspond to housing's peak spring selling season.

The NAHB's housing market index of 2025's second quarter averaged an abysmal 35.3 points for its worst second-quarter average since the 27.0 points of Q2 2012. After jumping up from Q2 2020’s 41.7 to Q2 2021’s 82.3, the housing market index’s previous second-quarter averages subsequently descended to 2022’s 71.0, 2023’s 50.0, and 2024’s 46.3.

Moreover, the index steadily sank from March 2025's 42.7 points to June 2025's 32 points, where the latter was the lowest monthly reading since April 2020's COVID-suppressed 30.0 points.

The housing market index sank from Q2 2024’s 46.3 to Q2 2025’s 35.3 despite a dip by the 30-year mortgage yield’s accompanying average from 6.99% to a prospective 6.79%. Barring offsetting home price deflation and/or a pronounced acceleration of wage and salary income, the current unaffordability of housing for first-time homebuyers suggests the 30-year mortgage yield needs to drop under 6% if home sales are to improve materially.