Fed Funds Now Expected to End 2023 Under 5%

Markets shrugged off February’s much bigger than expected 311,000 new jobs as well as the smaller than expected downward revisions of December’s and January’s payrolls. Instead, markets took their cue from possibly widespread stress among smaller regional banks.

Fearing that banking stress extends beyond Silicon Valley Bank (SVB), the KBW bank stock price index was recently down by 19.7% from where it was prior to February 3’s release of a very strong January jobs report. By contrast, the S&P 500 was off by a shallower 7.6%.

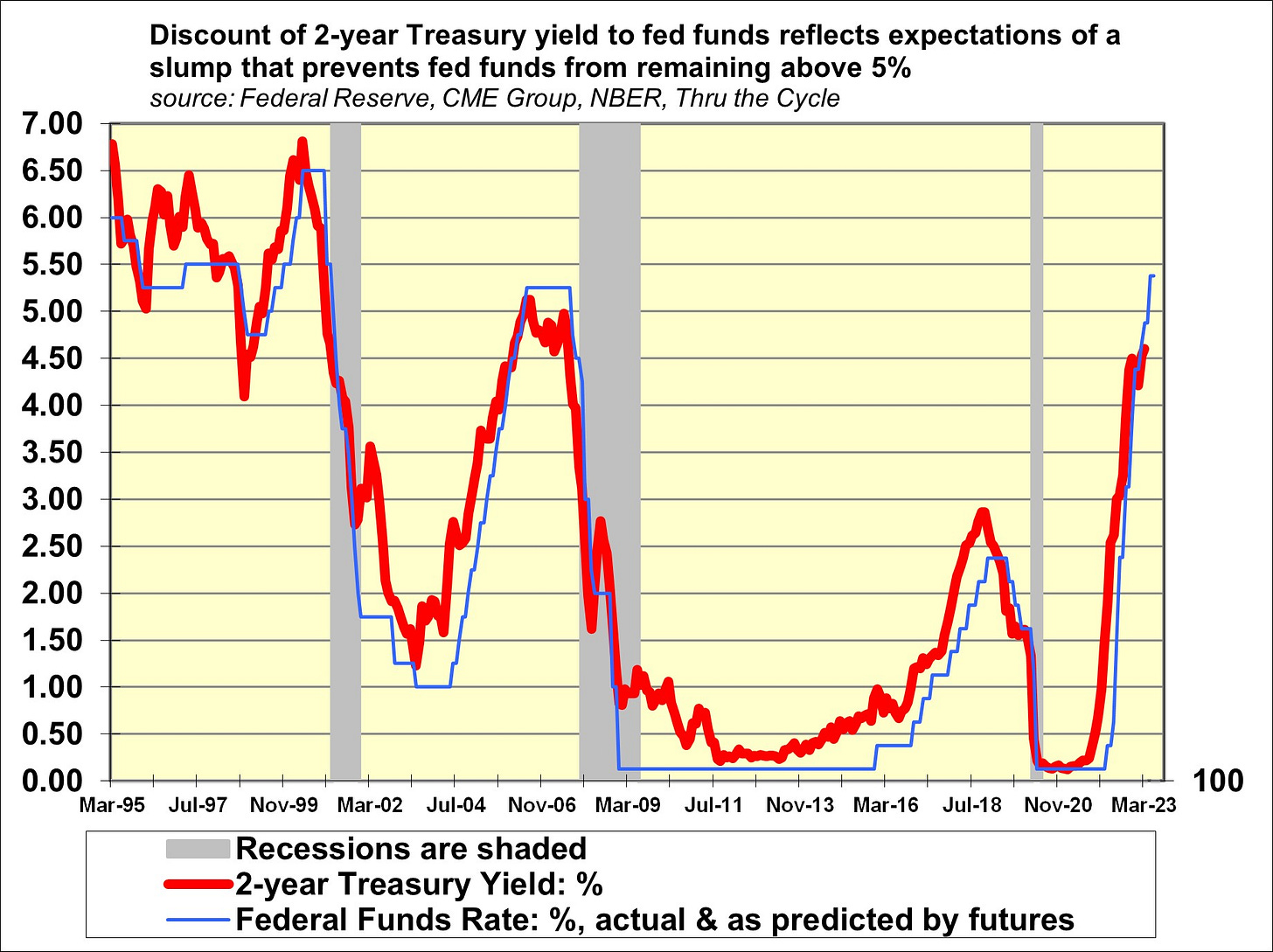

SVB reminded investors that the very steep increase by the federal funds rate from the 0.125% of early 2022 to a likely March 22 reading of 4.875% heightens both financial and macroeconomic risks. In response, the 10-year Treasury yield sank from March 2’s 4.08% close at March 10’s 3.70%, while the 2-year Treasury yield fell from March 8’s 5.05% to a now 4.60%.

The latest 2-year Treasury yield implies the bond market does not expect an extended stay by fed funds above 5%. In concert with the lower 2-year Treasury yield, the fed funds futures market has lowered its expected top for fed funds from 5.625% to 5.375% according to the CME Group’s FedWatch tool. Moreover, futures now assign an implied probability of 55% to fed funds ending 2023 under 5%. The 4.60% 2-year Treasury yield believes the fed funds rate will end 2023 under 5% and remain under 5% throughout 2024.

During the five days prior to the February 2nd release of January’s jobs report, the averages were 4.17% for the 2-year Treasury yield and 3.48% for the 10-year yield.