Consumers’ Miserable Sentiment May Curb Holiday Spending

Black Friday sales may offer insight regarding the pace of US consumer spending ...

We enter 2025’s holiday shopping season with prices deemed to be too high and jobs seen as being too few.

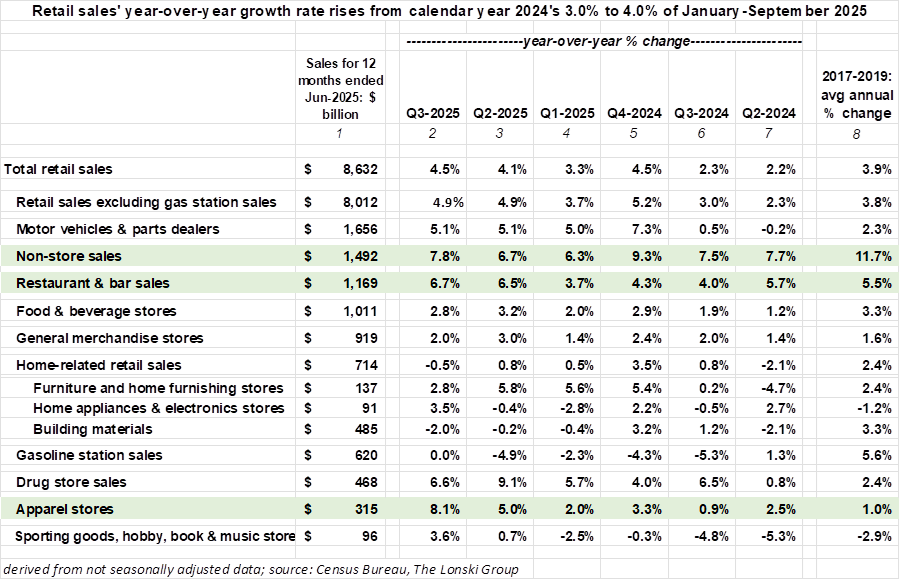

I expect holiday spending’s annual growth rate will slow by roughly half of a percentage point from 2024 to 2025. I believe the year-over-year growth rate for retail sales excluding gas station sales will slow from the 4.9% of November-December 2024 to a pace no faster than 4.5% for November-December 2025.

People are down on the economy because of affordability, inadequate employment income, and a sense of hopelessness about future growth opportunities. One might be able to uncover positive readings on the US economy until the cows come home. However, persistent, recession-like readings on consumer sentiment will eventually curb consumer spending.

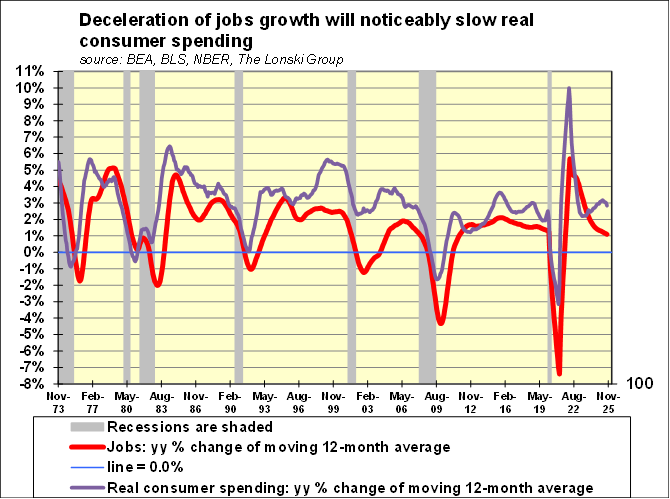

The lack of jobs creation warns of a deceleration by employment income that will eventually slow consumer spending. After expanding by 0.6% per month, on average, during July and August of 2025, September’s seasonally adjusted retail sales excluding gasoline station sales were unchanged from August 2025.

Many expect an unanticipated acceleration by consumer spending will end during 2025’s holiday shopping season. However, throughout 2025, professional prognosticators have frequently underestimated real consumer spending. As recently as September 24, 2025, the Bloomberg consensus foresaw only a 1.6% annualized sequential rise for Q3-2025’s real consumer spending that has since been revised higher to 3.1%.

Equity analysts also underestimated consumer spending …

Economists are not alone as far as underestimating consumer spending. At the end of September 2025, the FactSet consensus forecast of security analysts projected a year-over-year increases of 4.1% for the Q3 2025 revenues of S&P 500 member companies belonging to the consumer discretionary group. Instead, the Q3 2025 revenue growth of consumer-discretionary member companies was recently at a much faster 7.3%. For S&P 500 companies specializing in consumer staples, the yearly increase of Q3 2025’s revenues quickened from an end-of-September forecast of 3.3% to a recent and actual 4.9%.

Wealth effect explains paradox of low consumer sentiment and lively consumer spending …

Some ascribe the chronic underestimation of 2025’s consumer spending on the underappreciated lift to consumer spending provided by the wealth effect. From Q4 2019 ( or just prior to COVID’s arrival) to Q2 2025, the 6.7% averaged annual growth of household sector financial assets (to $129.0 trillion) far outran the accompanying 4.4% growth of household-sector debt ( to $19.5 trillion, including mortgage debt). in turn, household financial assets net of household debt expanded by 7.2% annualized, on average (to $109.5 trillion). The latter was 3.6-times the size of Q2 2025’s $30.5 trillion annualized current-dollar GDP. At the end of 2007, or prior to the Great Recession, household financial assets net of net was at a smaller 2.6-times GDP.

For households having an income in the middle quintile of the income distribution (or between $62,000 and $104,000), their financial assets net of debt grew by 7.4% annualized since the end of 2019. In turn, the ratio of financial assets to debt for middle-income households rose from Q4 2019’s 2.8-times to Q2 2025’s 3.1-times.

The ratio of household debt to household financial assets plunged from 27% just prior to 2008’s start to the Great Recession to Q2 2025’s record low 15%.

After accelerating from Q2 2025’s 2.5% to Q3 2025’s prospective 3.1%, real consumer spending annualized sequential growth rate is expected to slow to 1.2% in the current quarter according to a Bloomberg survey of 76 economists that was taken during November 14 through November 19.

November 2025 set a record low for all November indices of consumer sentiment …

Consumers are feeling far from jolly at the start of 2025’s holiday shopping season. Compared to 2024’s holiday shopping season, consumer spending should slow during 2025’s holiday shopping season according to a record low November reading on US consumer sentiment and a recent Fox News national survey that has 76% of voters holding a negative view of the economy.

By contrast, a smaller 67% of surveyed voters viewed the economy negatively in July 2025. Moreover, the 76% now holding a negative view was up from the 70% at the end of President Biden’s term. The Fox News poll found a loss of support for the Trump economy even among Trump’s hard-core supporters.

Consumer confidence index plunges from November 2024’s Republican victory high …

After Trump and the Republicans won November 2024’s elections, the Conference Board’s index of US consumer confidence jumped up from the 104.8 average of the 3-months-ended October 2024 to November 2024’s 112.8. But surveyed consumers then concluded Washington’s new leadership would be unable to turn things around quickly and the consumer confidence index eased to January 2025’s 105.3.

The financial markets’ adverse reaction to Trump’s original version of reciprocal tariffs further disillusioned Americans. In response, the consumer confidence index plunged to April 2025’s 85.7.

After briefly recovering to July’s still subpar 98.7, the consumer confidence index subsequently plummeted to November’s 88.7.

Tariffs are not resolving issues regarding affordability and manufacturing jobs …

Tariffs are horrible optics for Republicans who owed their November 2024 success to voter dissatisfaction with the high cost of living under the Biden administration. Republicans won the presidency and congress because voters believed the Republicans would ameliorate affordability issues. Much to the contrary, tariffs have done nothing to resolve affordability issues, at least over the observable, near term. If anything, tariffs have put upward pressure on prices, while failing to prevent the loss of -49,000 manufacturing jobs since Trump assumed office. Maybe the Supreme Court will do the Trump administration a great favor.

The vagaries of tariff policy also have imposed an opportunity cost on the US economy. The growth of far too many businesses has been impeded by the resources devoted to tariffs and related uncertainties. The more businesses allocate resources to tariff-related issues, then fewer resources can be directed at growing the business or improving product quality. Thus far, tariffs imply higher prices and less production of high quality than otherwise. As usual, tariffs benefit few at a cost to many.

Another example of dreadful optics would be Elon Musk wielding a chain saw as symbolic of DOGE-related cutbacks in federal payrolls amid a marked slowing of private sector hiring activity.

September’s fastest annual rates of CPI and PPI inflation …

Oddly enough, despite tariffs, September 2025 showed a -0.1% annual rate of price deflation for apparel, while toy prices inched up by a minuscule 0.2% from September 2024.

According to September’s CPI, tariff-driven inflation was most notable among the following annual rates of inflation – the 18.9% of coffee, the 13.6% of audio equipment prices, the 6.6% for watch prices, the 6.1% for musical instruments, and the 5.9% for furniture.

September’s PPI showed the following annual rates of price inflation that were on the high side -- the 38.7% of beef and veal, the 55.0% of processed turkeys, the 32.1% of roasted coffee, the 22.2% of computer hardware, software & supplies the 13.9% of cable and satellite subscriber services, the 13.3% of portfolio management, the 13.2% of jewelry, platinum & karat gold, the 11.9% of residential natural gas, and the 7.3% of motor vehicle maintenance & repair.

Recent advances still leave consumer discretionary stocks up by tiny 3.7% for 2025-to-date …

Despite very low November readings on consumer sentiment and consumer confidence, consumer-related stocks have come on strong since Friday, November 21. Since November 21, the 4.4% advance by the S&P 500’s stock price index for member companies having considerable exposure to consumer discretionary spending advanced by 4.4% through the close of Wednesday, November 26. By comparison, the S&P 500’s comparably measured gain was 3.2%. Nevertheless, consumer discretionary’s strong showing since November 21 left the index up by merely 3.7% since year-end 2024, which was far behind the S&P 500’s accompanying advance of 15.8%.

Lack of quality labor limits the upside for noninflationary growth …

Tens of thousands of job openings go unfilled because of a lack of qualified applicants. The deterioration of primary and secondary school education gets much of the blame for shortgages of individuals wo possess skills needed to prosper in a modern advanced economy.

When it comes to educating the young, a number of emerging market countries outperform the US. It’s unbelievable that only 22% of US 12th graders are deemed proficient in math and merely 35% have attained proficiency in reading. If you lack proficiency in reading or math, you’ll have considerable difficulty mastering modern trades. Of course, if you can’t make it in trade school, you can always go to college and get a degree in activism.

Consider what is reportedly going on at the University of California at San Diego (UCSD), widely recognized as one of the US’ top universities. For example, Niche gives UC San Diego an A+ rating.

Nevertheless, since 2020, the number of freshmen entering UCSD with math skills below middle school level (grades 6 through 8) has swelled by 30-fold according to the New York Post. In response, UC San Diego has added a new course teaching primary and middle-school math. Shockingly, 13% of incoming freshmen had not mastered first-grade level math (basically for 6 and 7 year old children). The New York Post also mentioned how 25% of UCSD’s incoming freshmen could not solve for x in the following expression, 7 + 2 = x + 3.

No wonder the US needs so many H1-B visas. The US falls way short of fully developing student skills. At a minimum, the return of standardized testing is paramount, starting no later than the third grade. And the latter was the case for baby boomers. Of special importance is that standardized testing should not be politicized.

More so than today, the results of standardized tests administered to children during the early 1960s were better than expected. Of course, the young boomers were the last generation to benefit from sex discrimination that limited the career opportunities of women to mostly teaching and nursing. Moreover, it wasn’t until the 1970s that family and social structures began to weaken noticeably to the detriment of learning.

Stronger family structure would be of great help to education and the economy. As an aside, it’s high time to de-stigmatize fathers who are not a family’s primary breadwinner. A househusband who effectively nurtures his children is of great benefit to society.